Connecting the dots of investments and world economics for the next generation. It can be fun, educational and rewarding. Get resource Smart; GREEN with your home, car and life-style. Knowledge is the best path to learning from our past mistakes, personally, economically, globally...and to cut a new more peaceful future for mankind. It is your future to gain. Subscribe to XML Post; see XML icon below

Wednesday, December 16, 2009

Fat Cats are still running Wall Street

Tuesday, December 15, 2009

Employment Patterns

"Click on graph for larger image in new window. "

"Click on graph for larger image in new window. "Notice that hires (blue line) and separations (red and green together) are pretty close each month. When the blue line is above total separations, the economy is adding net jobs, when the blue line is below total separations, the economy is losing net jobs.

According to the JOLTS report, there were 3.966 million hires in October, and 4.203 million separations, or 237 thousand net jobs lost."

Thursday, December 3, 2009

The Shell Game - How the Federal Reserve is Monetizing Debt

Replacing private credit with public credit

Tuesday, August 25, 2009, 9:44 am, by cmartenson

Our entire monetary system, and by extension our economy, is a Ponzi economy in the sense that it really only operates well when in expansion mode

"Executive Summary

- The Federal Reserve and the federal government are attempting to "plug the gap" caused by a slowdown of private credit/debt creation.

- Non-US demand for the dollar must remain high, or the dollar will fall.

- Demand for US assets is in negative territory for 2009

- The TIC report and Federal Reserve Custody Account are reviewed and compared

- The Federal Reserve has effectively been monetizing US government debt by cleverly enabling foreign central banks to swap their Agency debt for Treasury debt.

- The shell game that the Fed is currently playing obscures the fact that money is being printed out of thin air and used to buy US government debt.

- The Federal Reserve is monetizing US Treasury debt and is doing so openly, both through its $300 billion commitment to buy Treasuries and by engaging in a sleight of hand maneuver that would make a street hustler from Brooklyn blush. ..."

Comment by Norton:

1. Send billions of dollars of taxpayer money to banks to make them liquid again and start lending.

2. Also, buy up bank distressed (junk) assets like CDO's, mortgage dirivatives are FULL value instead of "mark-to-market." Legitimize this process by dropping the "mark-to-market rule". All done with taxpayer money.

3. Uups, the banks are hording this money, paying out outsized bonuses to the executive crooks that caused this crisis, and using this cash on their financial statements to make it look like they are liquid and profitable. Keep in mind, they still have the junk CDOs' etc OFF the BOOKS.

4.FED lending rate to banks and interbank loans drops to zero. While the banks lend it out at average 6 %. This enables Bank of America to pay back the TARP funds early.

5. Wait though ... our taxpayer money is loaned out to the bank at ZERO interest. The bank turn around and loan it back to Joe Public or Joe business or buy Emerging Market investments making 10% plus on our money. Then they payback the TARP loan. So they have made money TWICE ON THE TAXPAYER: first by getting our $ at ) interest and then by loaning our money out to us at 6 to 20 to 30 percent and then the bank pays us back. WHAT AM I MISSING HERE?

6. Bank gets the "private "profits and we get the multi-generational "public" debt. MOre of it!

7. Oh yes, the FED promised to make their financial statements transparent; however, they just said NO to our Congress! OUr Congress has tried to sue the FED for not revealing this shell game, what they paid for distressed assets and what they are selling them for.

8. Meantime, the US Treasury is having auctions to sell US Bonds. When they have been too few buyers, so the FED steps in as a buyer using taxpayer money to payoff matured US Bond debt and issue new US Bond instruments. Can we see the money flow by the FED and Treasury for all of this? NO! They have refused the request.

How to Fill the Gaps Left by Dollar Decline

(This article was originally published on www.ft.com on November 5, 2009.)

It has become fashionable to speculate on the future of the US dollar as the world’s reserve currency. Amid an average 10 per cent decline in the past six months, analysts have tended to favour one of two conclusions. Some argue that, since you cannot replace something with nothing, the dollar’s global role is secured. Others feel that America’s medium-term prospects are now inconsistent with such a role.

As with many post-crisis issues, the reality is much more complex. This is not just because the dollar will be caught between these two extremes in the muddled middle for the foreseeable future, but also because the dollar is part of a bigger picture that concerns the evolving role of the US as the sole provider of a range of global public goods. At a time when the global system needs such anchors, this uncertainty raises a set of important policy issues.

A couple of decades ago, Charles Kindleberger, the economist best known today as the author of Manias, Panics and Crashes , identified five public goods that support a growth-oriented global economy: (1) acting as a consumer of last resort, (2) coordinating macro-economic policies, (3) supporting a stable system of exchange rates, (4) acting as a lender of last resort, and (5) providing counter-cyclical long-term lending.

In today’s globalised financial world, we would add two more goods to this list: providing the risk-less – a true AAA – asset to benchmark other instruments and activities, and supplying deep and predictable financial markets, which other countries can use to improve their financial intermediation processes.

On the eve of the crisis, the US was the unquestioned provider of all these public goods. But, with the crisis having originated at the core of the global system rather than the periphery, almost every one of them is weaker. As a result, there are two policy questions that need to be addressed: first, which of the public goods can be restored, which can be jointly provided and which need to be replaced; and, second, how will this take place.

On the question of what can be restored, re-establishing the credibility and predictability of US financial markets requires well-designed reform of financial supervision and a credible medium-term programme to rein in the budget deficit and limit the growth of US government debt.

On the question of what can be jointly provided, the expanded new role for the G-20 and reform agenda for the International Monetary Fund underscore the extent to which the management of global macroeconomic policy aspires to become more inclusive. This is positive. However, the jury is still out on whether these fora have sufficient teeth to resolve policy differences and convince governments to assume shared responsibilities.

We should also expect to see more discussion in the next few years on new types of reserve assets. While the discussion will include supranational vehicles (like an expanded role for the special drawing rights), the more interesting question is the broader use of currencies like the Chinese yuan. These options will not replace the central role of the US dollar, but supplement it at the margin.

There is one public good that needs to be replaced: the key role that the US has played as the engine of global growth. This role is now constrained by the debt of US households. A sustainable global economy needs other major sources of internal demand, particularly among economies such as China that have historically been focused on export-led growth.

The manner in which these transitions take place is critical. One risk is that key actors will resist these secular changes and seek to reconstitute an outmoded system that no longer fits post-crisis realities. At the other extreme is the risk that major powers go their own way, forsaking effective coordination of policies in favour of more nationalistic moves, such as aggressive currency management or trade and financial protectionism.

The best defence against these outcomes is early recognition and coordinated action. Key economic powers must shape their expectations and policy strategies to the changed contours of the global economy. They must also actively manage policy changes at the national and multilateral level in a way that broadens the provision of global public goods.

Mohamed El-Erian and Ramin Toloui are, respectively, chief executive and executive vice-president at Pimco.

Comment Norton: This is most thoughtful article I have found on the subject of US Dollar decline and changes in the Fiat Reserve Currency system.

Friday, November 6, 2009

South Hampton Doesn't Give a Hoot About "Clawbacks"

There’s Just No Way I Can Compete

One might presume that there is some sort of “buyout clause.” But no one in Jersey can seem to figure out what it is, or whether it is more or less than the $11.4 million that has been funneled across the river – and most probably out to the Hamptons – since the bonds were sold.

So long as the bureaucrats in New Jersey and Washington remain clueless, and the con men at Goldman et al. remain shameless, the Lass clan is pretty much assured to be sweating out its summers right here in Maryland."

Norton: So what has changed? Destiny of Greed and fleesing of the majority continues. For one reason, the majority that used to be the middle class engine of America has now dropped into an new majoritty of ecomonically un der-classed, under-employed, two or more job overworked Americans that coincidently do not have the time to complain or keep up with all the scams of the elite. The elite are quite aware of this and count on it to continue the fleesing!

Wednesday, October 14, 2009

Public Health before Wall Street Wealth

Wednesday, September 9, 2009

Why Is Congress Agnostic About Natural Gas?

Noe=rton's comment: We are missing an obvious energy future in the USA here. Let's get going for vehicles that run on natural gas!

Tuesday, September 1, 2009

Will the Downturn in the Baltic Dry Index Lead to a Correction in the S&P 500? greenfaucet

The Quiet Coup - The Atlantic (May 2009)

first Russia

now USA = Banana Republic!

"...Typically, these countries are in a desperate economic situation for one simple reason—the powerful elites within them overreached in good times and took too many risks. Emerging-market governments and their private-sector allies commonly form a tight-knit—and, most of the time, genteel—oligarchy, running the country rather like a profit-seeking company...

Squeezing the oligarchs, though, is seldom the strategy of choice among emerging-market governments. Quite the contrary: at the outset of the crisis, the oligarchs are usually among the first to get extra help from the government, such as preferential access to foreign currency, or maybe a nice tax break, or—here’s a classic Kremlin bailout technique—the assumption of private debt obligations by the government...

Becoming a Banana Republic

In its depth and suddenness, the U.S. economic and financial crisis is shockingly reminiscent of moments we have recently seen in emerging markets (and only in emerging markets): South Korea (1997), Malaysia (1998), Russia and Argentina (time and again). In each of those cases, global investors, afraid that the country or its financial sector wouldn’t be able to pay off mountainous debt, suddenly stopped lending. And in each case, that fear became self-fulfilling, as banks that couldn’t roll over their debt did, in fact, become unable to pay. This is precisely what drove Lehman Brothers into bankruptcy on September 15, causing all sources of funding to the U.S. financial sector to dry up overnight. Just as in emerging-market crises, the weakness in the banking system has quickly rippled out into the rest of the economy, causing a severe economic contraction and hardship for millions of people.

But there’s a deeper and more disturbing similarity: elite business interests—financiers, in the case of the U.S.—played a central role in creating the crisis

Sunday, August 30, 2009

Going Broke on $50,000: Median household Budget

Posted by mybudget360 in Employment, baby boomers, banks, budget, debt, economy, frugal, government, income, investing, recession, retirment planning, savings, wealth preservation

3 Comment

..The recent recession is exposing how many American families have been treading on the edge. Problems were already in the system before the recession began but the downturn in the economy was the ultimate catalyst. Many families were using credit cards as a means of supplementing a decade of stagnant wages. The median household income for the entire country is $50,740. In addition we have 34,000,000 Americans now receiving some form of food stamps. They are not part of the middle class group. Yet when we dig deeper into the data, it is clear why so many Americans are going broke on $50,000 a year

Thursday, August 20, 2009

Upside: Fix-it man is doing fine | Marketplace From American Public Media

Upside: Fix-it man is doing fine | Marketplace From American Public Media: "The Upside

Upside: Fix-it man is doing fine

Not everyone has the money to buy a new refrigerator or washing machine. So when large appliances break, people call on repairman David Khorsandi to get their machines back in working order. He explains why his phone has been ringing non-stop"

Norton's comment: This could be my Plan B..........keeping food on the table. No bad!

Wednesday, August 19, 2009

Paul Craig Roberts: Americans: Serfs Ruled by Oligarchs

Norton's comment: Ugh! this rings true. Being led to our demise by gullibility and fear mongering and the illusion of a Great matho American ego.

Monday, August 17, 2009

Is Obama Punking Us? - NYTimes.com

Norton: this is a good summary of the pervasive ill-ease that many of us feel about the conduct of the fixes that are moving forward: the economic, health, sustainable energy promotions... most seem still rooted in the same power mechanisms on wall st and corporate board rooms, and congressional behavior that got us to this disaster in the first place. And then we have the Republicans that are doing their best to throw gasoline on the fires of change.

Obama is right. Our current course, be it economics, deficit, national debt, health care is unsustainable. It seems to me that public education is lacking to discern truth from the fear mongering that helps to sustain the unsustainable status quo. It is the status quo which continues to feed the benefits for the few in power to the jeopardy of the many. This country was build on the middle class. The bulk of economic growth and stability is based on the middle class and a strong small business development. These are NOT the sectors benefiting from these fixes. Additionally, the effectiveness of our voting public depends on an educated voter; that is, one that can source out the TRUTH in a barrage of third and fourth hand information sources that are designed to manipulate the public perception of TRUTH when people are NOT well equipped to think critically and discover the primary sources of information without all the fear mongering of hyper-talk.

Wednesday, August 12, 2009

Oil and Base Metals Keep Pace With Stocks

By Arthur Hill

The PerfChart below shows the key commodity related ETFs and the S&P 500 since early March. As the stock market surged, the US Oil Fund ETF (USO) and the Base Metals ETF (DBB) were the only two commodity ETFs able to keep pace. The Natural Gas ETF (UNG) remains the weakest of the group - by far

Squeezing the oligarchs ... in the USA!

"The crash has laid bare many unpleasant truths about the United States. One of the most alarming, says a former chief economist of the International Monetary Fund, is that the finance industry has effectively captured our government—a state of affairs that more typically describes emerging markets, and is at the center of many emerging-market crises.If the IMF’s staff could speak freely about the U.S., it would tell us what it tells all countries in this situation: recovery will fail unless we break the financial oligarchy that is blocking essential reform. And if we are to prevent a true depression, we’re running out of time."

"...The mood that accompanied these measures in Washington seemed to swing between nonchalance and outright celebration: finance unleashed, it was thought, would continue to propel the economy to greater heights...Looking just at the financial crisis (and leaving aside some problems of the larger economy), we face at least two major, interrelated problems. The first is a desperately ill banking sector that threatens to choke off any incipient recovery that the fiscal stimulus might generate. The second is a political balance of power that gives the financial sector a veto over public policy, even as that sector loses popular support..."

Read the complete essay here. Atlantic Monthly May 09 "the Quiet Coup"

E-mail Article

Printer Format

about the author: "Simon Johnson, a professor at MIT’s Sloan School of Management, was the chief economist at the International Monetary Fund during 2007 and 2008. He blogs about the financial crisis at baselinescenario.com, along with James Kwak, who also contributed to this essay."

Tuesday, August 11, 2009

Mega-Bear with the S&P since 2000

by Norton:

So where do we go from here?

If you can wait awhile and tolerate potential drop in oil and commodities in the interim, then it seems that the LT future for various commodities (hard assets) looks the best by category and may outpace even blue chip and tech sector favorites.

Friday, August 7, 2009

Generations X and Y - amongst the crash's hidden losers

— 12:06 PM ET 08/05/2009

Aug. 5--Will someone please tell me how this happened?

I'm not talking about Jon and Kate and their troubled televised marriage. Or Arlen, Joe and their congressional cage match -- two recent attention grabbers in the ignore-the-economy media swirl.

I'm talking about something that's not all over the news, but all over the nation, and hitting particularly hard, in my opinion, at Generations X and Y.

I'm talking about how middle-class life, and its promise of generational upward mobility, is unraveling before today's younger workers have had the chance to collect even a fraction of their due.

I'm talking about you! You're invisible . . . to policymakers, to the media, to yourselves. And many of you seem more worried about Jon, Kate and the kids.

Even if you've done all that your parents, teachers or college mentors told you to do back in the bullish '80s and '90s, even before you've hit your dreaded 40th birthday, you're scared that life won't be better than your parents', after all.

Panicking, dare I say, in a way that the previous generation was not at your age.

I hear you. I am you. But I have not been reading much about you or us, frankly. Consider this your shot, our shot, at trumping Jon and Kate.

First, let's all agree that the damage from last fall's stock market crash -- from pulverized retirement accounts to prodigious unemployment numbers -- has affected a large cross-section of Americans, from Baby Boomers on down to high school graduates.

And yes, there is acute strain on middle-class workers in their 50s, who are losing the good-paying jobs they had held for decades just as college tuition bills are rolling in for their children's educations.

But a more pernicious trend less in the news is that of workers in their early 40s, 30s and 20s, many of whom have been forced out of jobs before they could fully capitalize on careers.

They are being bounced mid-stream in their prime, before pocketing the wage hikes, promotions, pensions, perks, etc., that had characterized employment before the jobs scene became a game of musical chairs.

And unlike those older than us, our generation is experiencing this with less of a safety net for what's ahead.

The story line goes something like this: You've been laid off from a job where the only pension plan was either eliminated before you got there or whacked back a few years into your tenure. A 401(k)? Yes. A match? Dream on. A wage hike? When you hit your 30s, your time will come for that.

You were laid off at age 28, 35, or, in the case of one old college pal last year, just before your 40th birthday. You find a new job at less pay, only to fear another layoff may be just around the corner. You've been there before. You can smell it. You're a veteran now.

You buy a used minivan off eBay (EBAY

Loading...

) while cramming prerequisites at night for a new career, where you humbly hope to be a newbie at the bottom of the pay scale in a few years.

What this means is a lot of lost wages in your prime. Savings you'll never save, cash you'll never get to spend.

How's this for a kicker: By retirement, as some predict, Social Security will have gone completely dry from paying all the workers ahead of you.

Yeah. Good stuff, as the kids say.

So what do you do with all this? Who do you turn to for help?

Harvard law professor Elizabeth Warren, who has written on the precarious condition of the middle class, told my colleague Jeff Gelles recently that government isn't paying attention to people like you.

"There is no one in Washington -- no agency -- whose principal responsibility is the consumer, or watching out for the economic health of the American family. No one," Warren said in a June article.

The way to cope, for now, must be a cross between Darwinian survival and playing the slots: Scrap and scrape. Cut your expenses, slash your expectations for life (fingers crossed) and hope it all works out so that someone, somewhere, is there to take care of you when you're old.

If that's not enough, Jon and Kate invite you into their dysfunctional lives again this year. Join them, why don't you. All the kids are doing it.

------

Mike Armstrong is away. Contact Maria Panaritis at 215-854-2431 or mpanaritis@phillynews.com.

To see more of The Philadelphia Inquirer, or to subscribe to the newspaper, go to http://www.philly.com/inquirer.

Copyright (c) 2009, The Philadelphia Inquirer

Distributed by McClatchy-Tribune Information Services. For reprints, email tmsreprints@permissionsgroup.com, call 800-374-7985 or 847-635-6550, send a fax to 847-635-6968, or write to The Permissions Group Inc., 1247 Milwaukee Ave., Suite 303, Glenview, IL 60025, USA.

Norton: this is so depressing, I hesitate to talk about it with my adult children. Note though it is much of what I as an early boomer have gone through my entire working life in the 1970 through current and beyond.But it is NOT what I wanted for my children and their children! Ugh!

Wednesday, August 5, 2009

Rail traffic: The economic indicator that's not improving

Rail shipments in the last four weeks are down 18.6 percent compared to 2008, which is comparable to the 18.8 percent year-to-date decline versus the same period in 2008."

Norton: It is not over yet.

Thursday, July 30, 2009

Has the housing market hit bottom?

housing stock vs. new home construction inventory

housing stock vs. new home construction inventoryInterestingly, there couldn’t have been two different eras for the homebuilders as far as the cost of money is concerned - back then they were sending truck loads of sawed up two-by-fours to the Federal Reserve building in Washington D.C. because Paul Volcker was on a mission to squash inflation with interest rates approaching 20 percent, whereas, today, the Fed has interest rates pegged at zero.

And speaking of the central bank, their legions of economists might think that housing has bottomed when looking at new home construction because this has a direct impact on economic growth - residential construction has been a drag on GDP for about four years now and, from a direct macro-economic perspective, the worst is probably behind us.

For the homebuilders, it’s hard to imagine how things could get any worse than they were in January, so, unless this downturn morphs back into the Great Depression II, things have got to get better. In this case, it’s probably fair to say that the bottom is already behind us.

Wednesday, July 29, 2009

Exploit Trader Advantages for yourself

In my opinion, the market is telling us that we should be willing to trade both long and short for the time being. ...

Wednesday, July 22, 2009

The American Empire Is Bankrupt

by Chris HedgesThere are three categories of the balance-of-payment deficits. America imports more than it exports. This is trade. Wall Street and American corporations buy up foreign companies. This is capital movement. The third and most important balance-of-payment deficit for the past 50 years has been Pentagon spending abroad. It is primarily military spending that has been responsible for the balance-of-payments deficit for the last five decades. Look at table five in the Balance of Payments Report, published in the Survey of Current Business quarterly, and check under military spending. There you can see the deficit.

To fund our permanent war economy, we have been flooding the world with dollars. The foreign recipients turn the dollars over to their central banks for local currency. The central banks then have a problem. If a central bank does not spend the money in the United States then the exchange rate against the dollar will go up. This will penalize exporters. This has allowed America to print money without restraint to buy imports and foreign companies, fund our military expansion and ensure that foreign nations like China continue to buy our treasury bonds. This cycle appears now to be over. Once the dollar cannot flood central banks and no one buys our treasury bonds, our empire collapses. The profligate spending on the military, some $1 trillion when everything is counted, will be unsustainable.

“We will have to finance our own military spending,” Hudson warned, “and the only way to do this will be to sharply cut back wage rates. The class war is back in business. Wall Street understands that. This is why it had Bush and Obama give it $10 trillion in a huge rip-off so it can have enough money to survive.”

Friday, July 17, 2009

The Joy of Sachs - Paul Krugman

.....The business of moving money around, of slicing, dicing and repackaging financial claims, has soared in importance compared with the actual production of useful stuff. The sector officially labeled “securities, commodity contracts and investments” has grown especially fast, from only 0.3 percent of G.D.P. in the late 1970s to 1.7 percent of G.D.P. in 2007. ...

The bottom line is that Goldman’s blowout quarter is good news for Goldman and the people who work there. It’s good news for financial superstars in general, whose paychecks are rapidly climbing back to precrisis levels. But it’s bad news for almost everyone else."

Norton's comment: So we haven't broken out of the same good old boy network that is running the economy for their own corp. benefit with the rest of us picking up the scraps on Main St. Get ready for a prolonged depression and slow recovery still leading to another bubble.

Thursday, July 16, 2009

Waiting for TARP bailout to hit Mainstreet USA..

How to Get a Free Yacht

All is not lost even in this economic turmoil!

How to Get a Free Yacht: "Intro How to Get a Free Yacht. Sound impossible? It's not.

Before long you'll be giving them away yourself.

Here's the table of contents of the whole saga:

Chapter 1: How to Get a Free Yacht

Chapter 2: Maiden Voyage of the Free Yacht

Chapter 3: Fix Broken Stix and other Trix

Chapter 4: Outboard Motor Mutilates Foot

Chapter 5: It's sinking and it's on Fire.

Chapter 6: How To Give Away a Free Yacht

Chapter 7: Get an Even Better One and Fabulize it.

Chapter 8: Celebrate Freedom

Chapter 9: Technicolor Dreamboat

Chapter 10: Privateer Knot

Chapter 11: Dismasted!

Chapter 12: Kiteboat!"

CLICK FOR DETAILS How to Get a Free Yacht:

norton's comment: Aha! Voila! My new motto:

"living high on living low!"

Hyperinflation Special Report - shadow statistics

"Have you ever wondered why the CPI, GDP and employment numbers run counter to your personal and business experiences? The problem lies in biased and often-manipulated government reporting. ...

How has the hyperinflation outlook changed since the Hyperinflation Special Report was published in April 2008?" Such is the most frequently asked question I receive these days.

The answer is that the outlook is little changed, since the following report outlines the basic issues and limited options for the U.S. government that were in play well before the current crises broke. The actions taken since by the federal government, U.S. Treasury and the Federal Reserve, in response to the still-deepening recession and ongoing systemic solvency woes, just exacerbated the long-range problems described in the report. The official actions likely have advanced the timing of the hyperinflation to the much nearer future, perhaps within the next year or two. Since September 2008, the Federal Reserve has been attempting to debase the U.S. dollar at an extraordinary pace, and such now is recognized widely among the major U.S. trading partners.

The current issues are discussed regularly and those analyses are available to subscribers in the Shadow Government Newsletter and related Flash Updates and Alerts. An updated Hyperinflation Special Report should be posted in the next several months....Printer Friendly (PDF) Version

Wednesday, July 15, 2009

The Story of STUFF!

Recession prompts Americans to embrace the simple life

"...Pastor Eric Dykstra, of Crossing Church, in Elk River, Minnesota, read a book by Julie Morgenstern, called Shed Your Stuff, Change Your Life, then found a blog by Dave Bruno of San Diego called the "100 Thing Challenge" where he encourages people to pare down their personal possessions to only 100 items. Bruno says he reduced his own possessions to fewer than that.Dykstra started to encouraged the members of his church to follow Bruno's example, and people began donating a lot to charity, including boats, furniture and snow blowers, until they had filled a warehouse. He, himself, went from five suits to one, and from a dozen ties to two.

The Northwest Earth Institute in Portland, Oregon offers "voluntary simplicity" courses and enrollment is up 50% in the past year. A 20-minute film called The Story of Stuff has been shown in hundreds of schools and been seen by 6.6 million people online since December 2007. The film shows the environmental costs of consumerism. Websites on living close to nature are also getting more traffic.

People are freeing themselves from the notion that owning a lot of stuff equals happiness..."

article source - USA today

Norton's comment: Yes, this is true. three years ago I moved from a nin room house to a two bedroom apartment. It has taken me three years to whittle down my possessions to fit. Antique dealers, yard sales, Craigslist, Uncle Henrys, donations etc. And I still will try out the 100 items challenge. I have NO regrets! It is a real lightening of pschological and physical load...and financial!

100 THINGS CHALLENGE - CLICK HERE

Monday, July 13, 2009

Gold, the U.S. Dollar, and the Chinese Yuan

Jul 09, 2009 - 05:42 PM

By: Jennifer_Barry

In late April, a Chinese sovereign wealth fund, the State Administration of Foreign Exchange, announced that China had purchased 454 metric tons of gold over the past six years. Officials indicated that this increase was accomplished by tapping domestic mine supply and refining scrap gold. As China reported gold production of 282 t last year, the reserves have absorbed about 25% of this output since 2003."

Wednesday, July 8, 2009

Interactive graphic of the day - economic cycles

Posted by: Economist.com WASHINGTON

IT MAY seem silly to devote an entire post to a link to an interactive graphic at the New York Times, but it won't once you go look at the graphic. It's mesmerising and informative. And it broadly comports with my view of the American economy, which is a bonus."

Norton's comment: Economics for the non-economist. COOL! CLICK HERE FOR THE SHOW

The Car That Makes Its Own Fuel

by noor on July 6, 2009

"The depletion of natural resources and their high prices has forced everyone to look for other alternatives to run cars and other electronic devices. This change of thought has made way to the invention of a new car that can make its own fuel, by an Israeli company. This car uses a unique system that can produce hydrogen inside the car using common metals such as magnesium and aluminum.

" Norton's comment: "Yes we can!" Detroit better grab this and run with it! It's my money of the barrel head.

Tuesday, June 23, 2009

FASB Close on 'Off-Balance' Sheet Change

"...The estimate is for $900 Billion in off-balance sheet assets in 2010, as the rule takes effect. I think it would be safe to say that this estimate is highly conservative, as were most estimates of the depth of the writedowns since the beginning of this debt deflation episode. If Citigroup had over $1Trln of these assets placed off-balance sheet in mystery entities, what do you think the rest had? Understand, that banks probably used excessive leverage to finance these assets!

How about $5.2 Trillion? Bloomberg's David Reilly discussed the threat in late March:

At the end of 2008, for example, off-balance-sheet assets at just the four biggest U.S. banks -- Bank of America Corp., Citigroup Inc., JPMorgan Chase & Co. and Wells Fargo & Co. -- were about $5.2 trillion, according to their 2008 annual filings.

Even if only a portion of those assets return to the banks - - as much as $1 trillion is one dark possibility -- it would take up lending capacity the government is trying to free. Whether these assets are "troubled" or "toxic," their return to bank balance sheets could slow efforts to get credit flowing again..."

Friday, June 19, 2009

Household debt by country - Ouch!

"Canadians' household debt is about 140 per cent of disposable income, compared with about 150 per cent in Britain and almost 170 per cent in the United States. The level is about 90 per cent among the countries that use the euro.

Canada's consumer debt to GDP ratio is quite high but not as bad as in the US. However, 140% is much worse than in the Eurozone. The real measure of how bad things will get is the unemployment rate. I suggest things in Canada will get a lot worse, yet not as bad as in the US.

That said, I cannot avoid pointing out the complete silliness of the Bank of Canada's statement: 'On the whole, the country's banks and credit markets are as strong as could be expected amid the deepest global recession since the Second World War'."

Monday, June 8, 2009

FreeStockCharts.com - Web's Best Streaming Realtime Stock Charts - Free

Best interactive real time charting I have found. Track your portolio here.

Best, Norton

Friday, June 5, 2009

Mourning Our Money at SmartMoney.com

Mourning Our Money at SmartMoney.com: "Mourning Our Money

After last year’s market meltdown wiped away huge chunks of their savings, more investors have decided to seek professional help. Just not from a financial advisor.

Manhattan grief counselor Diana Nash, for one, typically sees clients who are struggling with the loss of someone close—a parent, a child, a spouse. But lately, she’s taken on a handful of clients who want help dealing with a different kind of loss: their gutted retirement account. Though months have passed since the market meltdown, they still can’t deal with the fact that their nest egg is fried. “Some of them can’t get out of bed,” says Nash.

In some cases employers are footing the bill. Ken LeBeau, director of employee-assistance programs for health care giant Cigna, says that since last fall, call volume grew 25 percent thanks to all the folks grappling with financial fears, while calls seeking immediate counseling rose 60 percent. “The sense of urgency increased dramatically,” he says. We all feel it to some degree. Unless you were already broke when the markets started crashing last fall, the economy has probably subjected you to a tiresome parade of unpleasant feelings.

In fact, the stages of grief, first identified by Elisabeth Kübler-Ross to describe the experiences of the terminally ill, apply rather neatly to folks who suffer major market losses. There’s the denial: refusing to open your account statement. Then there’s the anger, which explains the ongoing national temper tantrum aimed at targets like AIG and Bernie Madoff. And who among us hasn’t done a little mental bargaining? So maybe we won’t see the Dow at 14000 again in our lifetime—we’ll settle for keeping our"

What is next?

Instead, you can pick one currency or a basket of currencies, that you believed is best protected from currency collapse and buy it against threatened currencies. But how do you deal with an environment when all currencies appears equally questionable- when all governments all loosening monetary policy and risking inflation? Really, the only answer is to invest in commodities that you think represent good stores of value, such as oil or gold, or the currencies that benefit when prices of such commodities are high. Naturally, the relationship between commodities and currencies is not cut-and-dried, and if the currency system were indeed beset by meltdown, it’s not clear to me that commodities would hold their value. But that’s fodder for another post…"

Wednesday, May 27, 2009

Forecast - Nouriel Roubini

I would agree that the rate of economic contraction is slowing down. But we're still contracting at a pretty fast rate. I see the economy contracting all the way through the end of the year, going from minus 6 to minus 2, not plus 2. And next year the growth of the economy is going to be very slow, 0.5 percent as opposed to the 2 percent–plus predicted by the consensus. Also, the unemployment rate this year is going to be above 10 percent, and is likely to be close to 11 percent next year. Thus, next year is still going to feel like a recession, even if we're technically out of the recession.

The outlook for Europe and Japan, both this year and next year, is even worse. Most of the advanced economies are going to do worse than the United States for a number of reasons, including structural factors in Japan and weak policy response in the case of the Euro zone.

The problems of the financial system are severe. Many banks are still insolvent. If you don't want to end up like Japan with zombie banks, it's better, as Bill Bradley suggested, to do what Sweden did: take over the insolvent banks, clean them up, separate good and bad assets, and sell them back in short order to the private sector.

Friday, May 22, 2009

The UN, China Want to Ditch the Dollar

It's kind of funny how the IMF (International Monetary Fund) has gone from irrelevance to center stage in just a matter of months. Following quickly on the heels of last week's news that the Federal Reserve plans to print up another trillion dollars came this announcement that a UN panel wants to replace the greenback with a shared basket of currencies.

Monday, according to this Reuters report (hat tip MA), China loudly seconded the plan.

Earlier Monday, China’s central bank governor, Zhou Xiaochuan, offered a bold proposal to overhaul the global monetary system and replace the dollar with the IMF SDR (Special Drawing Right).

The SDR, an international reserve asset created by the IMF in 1969 but little used since that time, has the potential to act as a super-sovereign reserve currency, eliminating risks inherent in any single currency used for that purpose.

In a speech that took the unusual step of being issued in both Chinese and English, Mr. Zhou was careful not to mention any "specific" currency that the SDR might replace....

Norton's comment: Brazil and China are coordinating for more mutual trade and interested in ditching the US Dollar. Watch EWZ, FXI...

Thursday, May 21, 2009

Friday, May 15, 2009

Acclaimed Economist Says Recession Is Over

The source is Robert J. Gordon, an acclaimed macroeconomist and professor at Northwestern University. It’s surprising to learn he thinks the recession is over, because he is one of seven members of the elite Business Cycle Dating Committee of the National Bureau of Economic Analysis . These are the people who decide officially, for the record books, when recessions begin and end—usually many months after the fact, when the decision is really obvious. I’m unaware of any previous case in which a member of this Committee has ever stepped forward and declared the end of a recession in real time.

Gordon bases his gutsy call on an indicator that he says the Committee never even looks at: claims for unemployment benefits. He’s talking about the so-called “jobless claims” number that is released every Thursday morning before the market opens. Based on detailed data from state agencies, it reports the number of workers who have asked for unemployment benefits in the previous week. As Gordon points out, there is no other major macroeconomic statistics that comes out so frequently, and so close to real time.

According to Gordon’s research, in every recession since 1974, the peak in jobless claims came within weeks of the bottom of the recession. This is a remarkable research result, in my opinion. I was impressed a year ago when economist Edward Leamer of UCLA wrote a paper that accurately explained recession timing with just three variables—the unemployment rate, total payroll jobs, and industrial production. But Gordon has done Leamer two better. Gordon has it down to a single variable: claims. And because claims data is available nearly immediately, investors can use Gordon’s insight to make actual trading decisions.

Claims are typically reported as a four-week moving average, to smooth out some of the random noise from week to week. All Gordon has done, really, is to make the simple observation that the peak in the four-week moving average coincides perfectly with the ends of recessions. I charted the data to prove it to myself, and he’s right. Here it is

Wednesday, May 13, 2009

Fiscal Meltdown will test the Bond and Dollar to the Breaking Point

Jessies Americain Cafe'Jesse's Café Américain: "Don't blame the Democrats alone for this. Instead blame a political system that is corrupted by Wall Street and lobbyist money, and a mainstream media dominated by four corporations feeding a stream of managed news and perception spin to gullible US households.

The day of reckoning is nearly at hand, in which the currency crisis in the US will shake the financial foundations of the global economy.

'Outlays are rising at 17% YOY the fastest nominal pace since late 1981. With receipts falling 14.6% YOY their fastest drop in at least 40 years the gap between their growth rates is also the widest in the record.

All these rates are accelerating and are threatening to push the deficit to more than 50% of receipts and - at $1.1 trillion and rising - to more than 10% of private GDP.'

Thanks to Sean Corrigan at Diapason Trading for this chart."

Friday, May 8, 2009

Thursday, May 7, 2009

Can we delude ourselves to prosperity?

"...You take the blue pill, the story ends, you wake up in your bed and believe whatever you want to believe.You take the red pill, you stay in Wonderland, and I show you how deep the rabbit hole goes."Morpheus in The Matrix

..The elite and their acolytes seem to believe that by sustaining the illusion of the Financial Matrix that we create a confidence that will support a national economic system that is based on a credit bubble and a mass illusion of wealth based on paper....

Can we delude ourselves to prosperity? Can a powerful nation and otherwise intelligent people be that venal, faithless and craven?Yes we can. We have been doing it for years. And it can only continue if we gain more control over the real world and the people in it, and bend them to our increasingly irrational will. The triumph of the will."

Wednesday, May 6, 2009

Why This Rally Is Unsustainable?

Thursday, April 30, 2009

Intel Chips: Coming Soon to a Smart Grid Near You

In the relatively near future, you can expect to see some announcements about Intel (INTC) getting its chips into smart grid equipment like intelligent meters.

That’s the word from Joe Jensen, general manager of the Intel Embedded Computing Group. The company has been working with a few companies on experimenting with Intel chips in smart grid equipment, he said.

The smart grid deals are part of an overall effort within Intel’s embedded processor division to expand where possible. The company already sells chips that are incorporated into wind turbines. Some wind turbines have up to 16 processors that track everything from power output to the pitch of the blades. If the blades don’t adjust to wind speed, they can shear off.

“A lot of the processing goes into preventing them from going into self-destruct,” he said. “They vary the blade pitch constantly.”

Wednesday, April 29, 2009

The worst six months in 50 years - How the World Works - Salon.com

Insiders are selling

Insiders from New York Stock Exchange-listed companies sold $8.32 worth of stock for every dollar bought in the first three weeks of April, according to Washington Service, which analyzes stock transactions of corporate insiders for more than 500 mostly institutional clients.

That’s the fastest rate of selling since October 2007, when U.S. stocks peaked and the 17-month bear market that wiped out more than half the market value of U.S. companies began."

Monday, April 27, 2009

Stealth Stocks Bull Market, Sell in May and Go Away?

MACD - The MACD indicator cross has given a SELL signal, at best this means sideways price action, but more probably a significant downtrend that will seek to correct the up trend from Dow 6470.

Trend Analysis - The rally has been strong AND powerful, but it is showing signs of running out of steam, this is evidenced by the shrinking gap between each up thrust following each correction with the most recent correction 'so far' failing to break to a new trend high which gives a risk of a lower low. The rally is tired folks, it needs to take a break.

Retracement Levels - 33% - 50% - 66% - The Dow has rallied from a trough of 6470 to a peak of 8190 totaling 1720 points, key retracement levels are 33% = 7,622; 50% = 7,330; 66% = 7,050. Therefore the minimum correction from the current swing peak is expected to carry between 7,622 to 7,330. Anticipating a rally to 8,750 this points to levels of 33% 8,000; 50% 7,610 - Which reinforces the target of 7,600, with probable overshoot lower implying 7,500.

Price Points - Immediate support levels are 7,800, 7750, and then 7,440. For the health of the stealth stocks bull market a correction should not carry below 7,440 this therefore implies support in the region of 7,500 to 7,440. Overhead resistance is clearly first at 8,190, then 8,400; with major resistance in the area 8,900 to 9,080. This implies the current upswing should continue into the area of between 8,400 to 8,900 with probability favouring 8,800.

Elliott Wave - My elliot wave interpretation implies that the market should continue rallying for another to 3 weeks to mark the end of the first impulse major wave towards 9,000. to be followed an A-B-C correction towards 7,500 for a larger wave 2 correction.

Swine Flu Black Swan ? - Swine fever is spreading, is this the big pandemic that we have been fearing all these years with the previous focus on avian flu? There is a good probability that the financial markets will discount the worst case scenario along the lines of avian flu a few years ago early next week, therefore this brings in an immediate bearish influence against what looked set as a continuing rally into early May which implies greater volatility than expected depending on the progress of the virus. Though amidst the overall gloom big pharma that produce treatments should rally.

How We Get Out of the Great Depression II

By Steven Stoft, March 2, 2009

Here we go again: Hoover got us in, and WWII got us out. Bush got us in, and

to his credit, starting trying to get us out. Though, mostly he threw money at bankers.

In the Great Depression, Roosevelt tried deficit spending, but he was too timid. Then he stopped in 1937 and the economy nose-dived. It took the humongous deficits of WWII to pull us out of the Great Depression. Those deficits blasted the economy from depression into overdrive.

Of course after the war, we had to pay off a huge national debt, but during that time, from 1946 to 1980, the economy was mainly quite prosperous. We hit a bad recession when Reagan took office, and his early deficit spending made sense (though he didn't know it). But then he continued to drive up the debt through the boom years that followed. That didn't make any sense.

We are now headed into the worst slump since 1938, and you better hope Obama can fix it because that was not a pretty time. Unfortunately, as in the Great Depression, the extreme conservatives would rather trash the country than have our government succeed. They are much worse than Bush.

The main thing to remember is that, with consumer spending going down, business is going to lay people off—not hire them. You can't blame business for this. It's just a vicious cycle the economy gets into. Any you can't blame consumers for not spending in bad times. The only way out of this, if we don't want to wait 10 or 20 years, is for the government to spend, pay unemployment insurance, or give tax breaks to people who will spend (not the rich). Of course there's also the problem of the banks. Obama should stop saving the bankers, and just take over the bad banks. Once they're working they can be sold back to the private sector.

Monday, April 20, 2009

Derivatives: A $700+ Trillion Bubble Waiting to Burst -- Seeking Alpha

According to the Bank for International Settlements [BIS], the global Over the Counter [OTC] derivatives market has grown almost 65% from $414.8 trillion in December, 2006 to $683.7 trillion in June of 2008. On the BIS’s own website, there are no updated figures for the notional derivatives market since June 2008, so we can likely assume, with some margin of safety, that this market has now grown to more than $700 trillion. Comparatively speaking, the total market cap of all major global stock markets is approximately $30 trillion.

Before I discuss how financial products could grow more than 65% during a time period when financial companies were imploding all over the world, let’s review the definition of a derivative, because this will explain how this market of financial products keeps becoming more valuable at a time when the value of many capital assets are sinking like a rock in an ocean"

Bank Credit Growth Drops Precipitously

Jesse's Café Américain: Bank Credit Growth Drops Precipitously: "08 April 2009

Bank Credit Growth Drops Precipitously

The Growth Rate of Total Credit at all US Commercial Banks is dropping precipitously as can be seen from the chart below.

This is a negative indicator for most banks involved in the actual business of banking, even as the spreads between Fed money and money on loan widen.

Advantage goes to those banks who are gaming the markets, also known as trading profits, which is probably the opposite outcome which Tim and Ben would desire, if they were thinking about it.

Should banks be trading in the markets at all for their own accounts? We think not.

Glass-Steagall should be reintroduced as quickly as possible to get the banks back in the business of banking."

America is Being Looted - Apr. 14, 2009 | Blogs at Chris Martenson - Chris Martenson's Blog, geithner, Goldman Sachs, TARP

As cynical as I am, I just can’t keep up.

That sentence is a paraphrase of a quote by Lily Tomlin that reads, “No matter how cynical you become, it's never enough to keep up.”

I have long been a cynic of the bailouts, and, unfortunately, I cannot detect even the slightest sliver of daylight between the prior and current administrations. The reason, I fear, is captured by this quote from Simon Johnson, the former Chief Economist at the IMF and current professor at MIT’s Sloan School of Management:

The crash has laid bare many unpleasant truths about the United States. One of the most alarming, says a former chief economist of the International Monetary Fund, is that the finance industry has effectively captured our government—a state of affairs that more typically describes emerging markets, and is at the center of many emerging-market crises. If the IMF’s staff could speak freely about the U.S., it would tell us what it tells all countries in this situation: recovery will fail unless we break the financial oligarchy that is blocking essential reform. And if we are to prevent a true depression, we’re running out of time."

The Credit Bubble Was a Ponzi Scheme Enabled by the US Dollar

Here is a picture of the US credit bubble, with the deleveraging which has just begun.

It is/was a Ponzi scheme, enabled by the advantages of controlling the reserve currency of the world, pure and simple.

It was the US dollar that was monetized, or more specifically US debt obligations, which are now substantially worthless and will have to take a significant haircut in real terms. This is similar to the Japanese experience in which they monetized their real estate."

Friday, April 17, 2009

China Financial Markets

April 13th, 2009 by Michael Pettis Filed in Balance of payments, Consumption and production, Exports and imports, Hot money, Reserves

Exports in March dropped a less-than-expected 17.1% from the same time last year – below expectations of 20% and the 21.1% drop for the first two months of 2009. Most of the articles I read in the Chinese and foreign press including, not surprisingly, comments from the customs bureau, hailed this as a sign that the export slump is bottoming out. According to an article in Saturday’s South China Morning Post, for example"

The US doesn’t name China a currency manipulator

Posted on Wednesday, April 15th, 2009

By bsetser

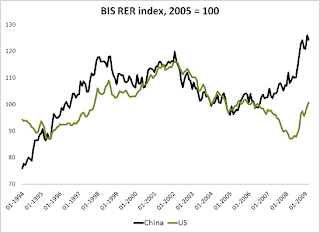

And the underlying issue remains: the biggest driver of moves in China’s real exchange rate remains moves in the dollar. History suggests that China cannot count on dollar appreciation to bring about the real appreciation it and the global economy need if China’s surplus — and thus China’s accumulation of money-losing foreign assets — is going to come down. It will be hard — in my view — to have a stable international monetary system if the currencies of all the major economies but one float against each other. And China is now a major economy by any measure.

Thursday, April 16, 2009

Rouse default swaps worth 29.25 percent in auction

That means that sellers of protection will need to pay out 70.75 percent of the value of the bonds they insured, or $7.07 million per $10 million of insurance sold. Credit default swaps are used to insure against a borrower defaulting.

Payments on the contracts were triggered after the company failed to pay more than $2 billion in debt due on March 16.

A group of General Growth's bondholders have asked their trustee to sue the mall owner for payment on their past-due bonds, The Wall Street Journal reported on Monday. For details, see [ID:nN13392097..

Norton's note: GGP.N who owns the Maine Mall has filed ch 11 bankrupcy April 16, 2009. Ouch!

Monday, April 13, 2009

Changing the Rules of the Blame Game

A cartoon in the Sunday comics shows that mustachioed fellow with monocle and top hat from the Monopoly game--"Rich Uncle Pennybags," he used to be called--standing along the roadside, destitute, holding a sign: "Will blame poor people for food." ..

A cartoon in the Sunday comics shows that mustachioed fellow with monocle and top hat from the Monopoly game--"Rich Uncle Pennybags," he used to be called--standing along the roadside, destitute, holding a sign: "Will blame poor people for food." ..He called for a 21st century version of the Pecora Commission, referring to hearings that sought the causes of the Great Depression, held during the 1930's by the US Senate Committee on Banking and Currency.

Ferdinand Pecora was the committee's chief counsel and interrogator, a Sicilian émigré who was a progressive devotee of trust busting Teddy Roosevelt and a former Manhattan assistant district attorney who successfully helped shut down more than a hundred Wall Street "bucket shops" selling bogus securities and commodity futures. He was relentless in his cross-examination of financial executives, including J.P. Morgan himself.

Pecora's investigation uncovered a variety of Wall Street calumnies - among them Morgan's "preferred list" of government and political insiders, including former President Coolidge and a Supreme Court justice, who were offered big discounts on stock deals. The hearings led to passage of the Securities Act of 1933 and the Securities Exchange Act of 1934.

In the preface to his 1939 memoir, Wall Street under Oath, Ferdinand Pecora told the story of his investigation and described an attitude amongst the Rich Uncle Pennybags of the financial world that will sound familiar to Bill Black and those who seek out the guilty today.

"That its leaders are eminently fitted to guide our nation, and that they would make a much better job of it than any other body of men, Wall Street does not for a moment doubt," Pecora wrote. "Indeed, if you now hearken to the Oracles of The Street, you will hear now and then that the money-changers have been much maligned. You will be told that a whole group of high-minded men, innocent of social or economic wrongdoing, were expelled from the temple because of the excesses of a few. You will be assured that they had nothing to do with the misfortunes that overtook the country in 1929-1933; that they were simply scapegoats, sacrificed on the altar of unreasoning public opinion to satisfy the wrath of a howling mob...."

According to Politico.com, at his March 27 White House meeting with the nation's top bankers, President Obama heard similar arguments and interrupted, saying, "Be careful how you make those statements, gentlemen. The public isn't buying that.... My administration is the only thing between you and the pitchforks."

Stand aside, Mr. President, and let us prod with our pitchforks to get at the facts."

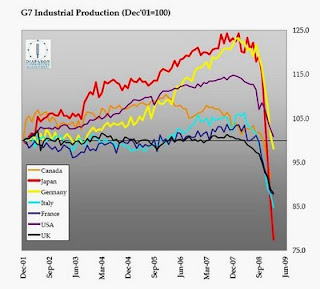

G7 Industrial Production Crashing

G7 Industrial Production Crashing

The production of real goods in the developed nations is plummeting. Even the mighty export driven economy of Japan appears to be heading lower as though it had fallen off a cliff.

Countries must begin to encourage consumption in their own economies. To do this, they ought not to be stimulating the old credit/speculation machine called the neo-liberal financial system"

And the Baltic shipping index has returned to a down trend. Record number of cargo ships are in dry dock. BALTIC DRY INDEX (ABOVE)

BALTIC DRY INDEX (ABOVE)

G7 INDUSTIRAL PRODUCTION

Tuesday, March 31, 2009

6 reasons I'm calling a bottom and a new bull

PAUL B. FARRELL

6 reasons I'm calling a bottom and a new bull

Forget Roubini: I'm the new Dr. Boom, ahead of Dr. Doom (again!)

By Paul B. Farrell, MarketWatch

Last update: 7:22 p.m. EDT March 30, 2009

ARROYO GRANDE, Calif. (MarketWatch) -- OK, so you're one of millions of investors impatiently waiting on the sidelines, sitting with $2.5 trillion cash under your mattress, waiting for the right moment, that signal screaming: "Bottom's in, start buying!" Yes, it'll go down again, but the bottom's in, thanks to a great March, possibly the third best month since 1950, so it's time to jump back in and buy, buy, buy!

You heard me, I'm calling the bottom, beating Dr. Doom to the punch again (yes, again). Last time we were predicting the recession. This time we're calling the market bottom and a new bull.

How the Financial Industry Holds America Captive

You heard this here first. from Jessies Crossroads Cafe

"The crash has laid bare many unpleasant truths about the United States. One of the most alarming, says a former chief economist of the International Monetary Fund, is that the finance industry has effectively captured our government—a state of affairs that more typically describes emerging markets, and is at the center of many emerging-market crises. If the IMF’s staff could speak freely about the U.S., it would tell us what it tells all countries in this situation: recovery will fail unless we break the financial oligarchy that is blocking essential reform. And if we are to prevent a true depression, we’re running out of time."The Quiet Coup - Simon Johnson - The Atlantic Monthly

Friday, March 27, 2009

Double-digit unemployment rates are un-American

A total of seven states have passed the 10% unemployment rate as the Jobless Slump Spreads.

The number of U.S. states with a jobless rate exceeding 10 percent almost doubled in February as the worst employment slump in the postwar era spread....

Double-digit unemployment hits 7 states

Seven states posted unemployment rates above 10 percent in February, as Ohio inched toward the double digits, according to seasonally adjusted figures released Friday morning by the U.S. Bureau of Labor Statistics.

Ohio's unemployment rate for February was 9.4 percent, an increase of 3.5 percentage-points.

Michigan registered the nation’s worst rate, with 12 percent of its labor force out of work as of February 2009.

Also in double digits were South Carolina (11 percent), Oregon (10.8 percent), North Carolina (10.7 percent), California (10.5 percent), Rhode Island (10.5 percent), and Nevada (10.1 percent).

All seven of those states experienced rapid rises in unemployment during the past year. North Carolina’s increase was the sharpest in the nation, up 5.5 percentage points from its February 2008 jobless rate of 5.2 percent.

Job Losses Compared

Wednesday, February 18, 2009

Thursday, February 12, 2009

Worst Recession In 100 Years - starting NOW!

Mish's Global Economic Trend Analysis: Worst Recession In 100 Years:

comments by Ed Ball,

"Ed Balls, the PM's closest ally, warns that downturn is ferocious and says impact will last 15 years.In an extraordinary admission about the severity of the economic downturn, Ed Balls even predicted that its effects would still be felt 15 years from now. The Schools Secretary's comments carry added weight because he is a former chief economic adviser to the Treasury and regarded as one of the Prime Ministers's closest allies...."

"The minister stunned his audience at a Labour conference in Yorkshire by forecasting that times could be tougher than in the depression of the 1930s, when male unemployment in some cities reached 70 per cent. He also appeared to hint that the recession could play into the hands of the far right.

'The economy is going to define our politics in this region and in Britain in the next year, the next five years, the next 10 and even the next 15 years,' Mr Balls said. 'These are seismic events that are going to change the political landscape. I think this is a financial crisis more extreme and more serious than that of the 1930s, and we all remember how the politics of that era were shaped by the economy.'"

So make your energy and life style plans to survive for the next 15 years............ or so. Going Green can be a 15 to 20 year investment. Now is the time to get going with it! by Norton.

Courtesy of Martin's Capital http://www.martincapital.com/chart-pgs/Ch_sales.htm

Wednesday, February 4, 2009

20 Reuse Ideas for Common Household Products

Low Tech Fixes, don't wait for Washington DC to save money and energy!

Medicine Cabinet MacGyver - Don't toss that old toothbrush or lipstick; they're tools

Strip Paint from Hardware - Clean paint-encrusted fixtures using an old crock pot- 10 Uses for Aluminum Foil - Make a refill funnel, sharpen scissors, radiate heat, more

- Cleaning with Condiments - 5 nontoxic cleaners you can find right in your pantry

Split Logs Safely - Build a steady holder with two old automobile tires - 10 Uses for Car Wax - Use the high-shine, scratch-filler on nonporous home surfaces too

Remedy Ice Dams - Expedite melting on your roof with help from panty hose - Unstick Furniture Drawers - How a candle stick can get you to your socks faster

- 10 Uses for Coffee Filters - Use the lint-free sheets for windows, rust prevention, more

Use Bathwater for Plants -3 graywater retrofits to shrink your water bill - 10 Uses for Tennis Balls - Erase scuff marks, remove a broken lightbulb, open jars, more

Tuesday, February 3, 2009

Let banks fail, says Nobel economist Joseph Stiglitz - Telegraph

Monday, January 19, 2009

Good News in the CPI

The two most common ways BLS officials do this is to compare a) December to December, calendar year data; b) annual average CPI for 2008 versus average for 2007.

Most years, the variations between these approaches is quite minor. However, given the volatility we have seen in inflation data — most especially food, energy and commodity prices — this year, the two approaches produce very different results:

A mathematical oddity in Friday’s consumer price index means you can claim with some statistical backing that inflation last year was either 0.1% or 3.8%."

Good News in the CPI

Thursday, January 15, 2009

US Employment Slump Chart - a GOOD LEADING ECON INDICATOR

BY PERCENT OF US WORK FORCE

BY JOB NUMBERS

BY JOB NUMBERSNorton's comment: When these numbers turn around, so will the economy. These are better indicators than unemployment since the govt plays with those #s, for example, people that have given up trying to look for work.

Bear Market Bottoms & P/E Ratios- 100 yr perspective

Bob Bronson notes Supercycle Bear Market bottoms have little to do with current P/E ratios. Financial theory and 138 years of history covered in our P/E Predictor Study I demonstrates their only predictive value is if earnings in the denominator are properly averaged over a multi-year period and the results are used to predict stock market prices over the next 10 to 20 years.

It makes no difference if operating earnings or income tax-based NIPA earnings are used instead of “as reported” GAAP earnings, and it makes no difference if exact future earnings are used instead of trailing earnings. Of course, the coming stock market low can be divided by some form of earnings measured over the past or even future four quarters to get a P/E ratio, but it will have no meaningful predictive value for the stock market over the following quarter, year or even over many years. Both history and financial theory support this assertion. The stock market has had a large range of both positive and negative performances for the same such calculated P/E ratio

Norton's comment: Let's not forget we are part of a long term statistical market behavior. Set your portfolio to minimize the volatility yet still benefit from either a big upturn or downturn. That is the task at hand. For me, the former investment instruments amount to less than 15% of my portfolio. The rest is on the sidelines for now. I am watching for any leading indicators to show a turn around; such as, blatic dry index