Smart Grid Technology coming to your home electric meterBy Michael Kanellos

In the relatively near future, you can expect to see some announcements about Intel (INTC) getting its chips into smart grid equipment like intelligent meters.

That’s the word from Joe Jensen, general manager of the Intel Embedded Computing Group. The company has been working with a few companies on experimenting with Intel chips in smart grid equipment, he said.

The smart grid deals are part of an overall effort within Intel’s embedded processor division to expand where possible. The company already sells chips that are incorporated into wind turbines. Some wind turbines have up to 16 processors that track everything from power output to the pitch of the blades. If the blades don’t adjust to wind speed, they can shear off.

“A lot of the processing goes into preventing them from going into self-destruct,” he said. “They vary the blade pitch constantly.”

Connecting the dots of investments and world economics for the next generation. It can be fun, educational and rewarding. Get resource Smart; GREEN with your home, car and life-style. Knowledge is the best path to learning from our past mistakes, personally, economically, globally...and to cut a new more peaceful future for mankind. It is your future to gain. Subscribe to XML Post; see XML icon below

Thursday, April 30, 2009

Wednesday, April 29, 2009

The worst six months in 50 years - How the World Works - Salon.com

The worst six months in 50 years - How the World Works - Salon.com: "Despite all the negative attention devoted to the big spending Obama government, government spending fell by a pretty sharp 3.9 percent in the first quarter of 2009. Bloomberg says that 'the drop reflected cutbacks in defense spending and the biggest decrease in state and local government outlays since 1981.' This means a) the stimulus spending isn't getting disbursed quickly enough, and b) the federal government's aggressive efforts to boost demand aren't keeping up with collapsing state economies"

Insiders are selling

Jesse's Café Américain: "Insiders Sell

Insiders from New York Stock Exchange-listed companies sold $8.32 worth of stock for every dollar bought in the first three weeks of April, according to Washington Service, which analyzes stock transactions of corporate insiders for more than 500 mostly institutional clients.

That’s the fastest rate of selling since October 2007, when U.S. stocks peaked and the 17-month bear market that wiped out more than half the market value of U.S. companies began."

Insiders from New York Stock Exchange-listed companies sold $8.32 worth of stock for every dollar bought in the first three weeks of April, according to Washington Service, which analyzes stock transactions of corporate insiders for more than 500 mostly institutional clients.

That’s the fastest rate of selling since October 2007, when U.S. stocks peaked and the 17-month bear market that wiped out more than half the market value of U.S. companies began."

Monday, April 27, 2009

Stealth Stocks Bull Market, Sell in May and Go Away?

The anticipated target for the current bull market by year end is 50%, the move to date amounts to more than 54% of the target in less than than 15% of the time period which gives ample time for several reactions lower against the trend. Therefore the only question now is how deep could the downtrend be, in that regard we have price points, retracement levels, and the MACD indicator to look at.

MACD - The MACD indicator cross has given a SELL signal, at best this means sideways price action, but more probably a significant downtrend that will seek to correct the up trend from Dow 6470.

Trend Analysis - The rally has been strong AND powerful, but it is showing signs of running out of steam, this is evidenced by the shrinking gap between each up thrust following each correction with the most recent correction 'so far' failing to break to a new trend high which gives a risk of a lower low. The rally is tired folks, it needs to take a break.

Retracement Levels - 33% - 50% - 66% - The Dow has rallied from a trough of 6470 to a peak of 8190 totaling 1720 points, key retracement levels are 33% = 7,622; 50% = 7,330; 66% = 7,050. Therefore the minimum correction from the current swing peak is expected to carry between 7,622 to 7,330. Anticipating a rally to 8,750 this points to levels of 33% 8,000; 50% 7,610 - Which reinforces the target of 7,600, with probable overshoot lower implying 7,500.

Price Points - Immediate support levels are 7,800, 7750, and then 7,440. For the health of the stealth stocks bull market a correction should not carry below 7,440 this therefore implies support in the region of 7,500 to 7,440. Overhead resistance is clearly first at 8,190, then 8,400; with major resistance in the area 8,900 to 9,080. This implies the current upswing should continue into the area of between 8,400 to 8,900 with probability favouring 8,800.

Elliott Wave - My elliot wave interpretation implies that the market should continue rallying for another to 3 weeks to mark the end of the first impulse major wave towards 9,000. to be followed an A-B-C correction towards 7,500 for a larger wave 2 correction.

Swine Flu Black Swan ? - Swine fever is spreading, is this the big pandemic that we have been fearing all these years with the previous focus on avian flu? There is a good probability that the financial markets will discount the worst case scenario along the lines of avian flu a few years ago early next week, therefore this brings in an immediate bearish influence against what looked set as a continuing rally into early May which implies greater volatility than expected depending on the progress of the virus. Though amidst the overall gloom big pharma that produce treatments should rally.

MACD - The MACD indicator cross has given a SELL signal, at best this means sideways price action, but more probably a significant downtrend that will seek to correct the up trend from Dow 6470.

Trend Analysis - The rally has been strong AND powerful, but it is showing signs of running out of steam, this is evidenced by the shrinking gap between each up thrust following each correction with the most recent correction 'so far' failing to break to a new trend high which gives a risk of a lower low. The rally is tired folks, it needs to take a break.

Retracement Levels - 33% - 50% - 66% - The Dow has rallied from a trough of 6470 to a peak of 8190 totaling 1720 points, key retracement levels are 33% = 7,622; 50% = 7,330; 66% = 7,050. Therefore the minimum correction from the current swing peak is expected to carry between 7,622 to 7,330. Anticipating a rally to 8,750 this points to levels of 33% 8,000; 50% 7,610 - Which reinforces the target of 7,600, with probable overshoot lower implying 7,500.

Price Points - Immediate support levels are 7,800, 7750, and then 7,440. For the health of the stealth stocks bull market a correction should not carry below 7,440 this therefore implies support in the region of 7,500 to 7,440. Overhead resistance is clearly first at 8,190, then 8,400; with major resistance in the area 8,900 to 9,080. This implies the current upswing should continue into the area of between 8,400 to 8,900 with probability favouring 8,800.

Elliott Wave - My elliot wave interpretation implies that the market should continue rallying for another to 3 weeks to mark the end of the first impulse major wave towards 9,000. to be followed an A-B-C correction towards 7,500 for a larger wave 2 correction.

Swine Flu Black Swan ? - Swine fever is spreading, is this the big pandemic that we have been fearing all these years with the previous focus on avian flu? There is a good probability that the financial markets will discount the worst case scenario along the lines of avian flu a few years ago early next week, therefore this brings in an immediate bearish influence against what looked set as a continuing rally into early May which implies greater volatility than expected depending on the progress of the virus. Though amidst the overall gloom big pharma that produce treatments should rally.

How We Get Out of the Great Depression II

How We Get Out of the Great Depression II

By Steven Stoft, March 2, 2009

Here we go again: Hoover got us in, and WWII got us out. Bush got us in, and

to his credit, starting trying to get us out. Though, mostly he threw money at bankers.

In the Great Depression, Roosevelt tried deficit spending, but he was too timid. Then he stopped in 1937 and the economy nose-dived. It took the humongous deficits of WWII to pull us out of the Great Depression. Those deficits blasted the economy from depression into overdrive.

Of course after the war, we had to pay off a huge national debt, but during that time, from 1946 to 1980, the economy was mainly quite prosperous. We hit a bad recession when Reagan took office, and his early deficit spending made sense (though he didn't know it). But then he continued to drive up the debt through the boom years that followed. That didn't make any sense.

We are now headed into the worst slump since 1938, and you better hope Obama can fix it because that was not a pretty time. Unfortunately, as in the Great Depression, the extreme conservatives would rather trash the country than have our government succeed. They are much worse than Bush.

The main thing to remember is that, with consumer spending going down, business is going to lay people off—not hire them. You can't blame business for this. It's just a vicious cycle the economy gets into. Any you can't blame consumers for not spending in bad times. The only way out of this, if we don't want to wait 10 or 20 years, is for the government to spend, pay unemployment insurance, or give tax breaks to people who will spend (not the rich). Of course there's also the problem of the banks. Obama should stop saving the bankers, and just take over the bad banks. Once they're working they can be sold back to the private sector.

By Steven Stoft, March 2, 2009

Here we go again: Hoover got us in, and WWII got us out. Bush got us in, and

to his credit, starting trying to get us out. Though, mostly he threw money at bankers.

In the Great Depression, Roosevelt tried deficit spending, but he was too timid. Then he stopped in 1937 and the economy nose-dived. It took the humongous deficits of WWII to pull us out of the Great Depression. Those deficits blasted the economy from depression into overdrive.

Of course after the war, we had to pay off a huge national debt, but during that time, from 1946 to 1980, the economy was mainly quite prosperous. We hit a bad recession when Reagan took office, and his early deficit spending made sense (though he didn't know it). But then he continued to drive up the debt through the boom years that followed. That didn't make any sense.

We are now headed into the worst slump since 1938, and you better hope Obama can fix it because that was not a pretty time. Unfortunately, as in the Great Depression, the extreme conservatives would rather trash the country than have our government succeed. They are much worse than Bush.

The main thing to remember is that, with consumer spending going down, business is going to lay people off—not hire them. You can't blame business for this. It's just a vicious cycle the economy gets into. Any you can't blame consumers for not spending in bad times. The only way out of this, if we don't want to wait 10 or 20 years, is for the government to spend, pay unemployment insurance, or give tax breaks to people who will spend (not the rich). Of course there's also the problem of the banks. Obama should stop saving the bankers, and just take over the bad banks. Once they're working they can be sold back to the private sector.

Monday, April 20, 2009

Derivatives: A $700+ Trillion Bubble Waiting to Burst -- Seeking Alpha

Derivatives: A $700+ Trillion Bubble Waiting to Burst -- Seeking Alpha: "In the past three years, while banks all over the world and Wall Street were imploding, while some $40-$50 trillion of capital was being destroyed in global stock markets, one financial market kept growing. That market is the financial derivatives market.

According to the Bank for International Settlements [BIS], the global Over the Counter [OTC] derivatives market has grown almost 65% from $414.8 trillion in December, 2006 to $683.7 trillion in June of 2008. On the BIS’s own website, there are no updated figures for the notional derivatives market since June 2008, so we can likely assume, with some margin of safety, that this market has now grown to more than $700 trillion. Comparatively speaking, the total market cap of all major global stock markets is approximately $30 trillion.

Before I discuss how financial products could grow more than 65% during a time period when financial companies were imploding all over the world, let’s review the definition of a derivative, because this will explain how this market of financial products keeps becoming more valuable at a time when the value of many capital assets are sinking like a rock in an ocean"

According to the Bank for International Settlements [BIS], the global Over the Counter [OTC] derivatives market has grown almost 65% from $414.8 trillion in December, 2006 to $683.7 trillion in June of 2008. On the BIS’s own website, there are no updated figures for the notional derivatives market since June 2008, so we can likely assume, with some margin of safety, that this market has now grown to more than $700 trillion. Comparatively speaking, the total market cap of all major global stock markets is approximately $30 trillion.

Before I discuss how financial products could grow more than 65% during a time period when financial companies were imploding all over the world, let’s review the definition of a derivative, because this will explain how this market of financial products keeps becoming more valuable at a time when the value of many capital assets are sinking like a rock in an ocean"

Bank Credit Growth Drops Precipitously

Jesse's Café Américain: Bank Credit Growth Drops Precipitously: "08 April 2009

Bank Credit Growth Drops Precipitously

The Growth Rate of Total Credit at all US Commercial Banks is dropping precipitously as can be seen from the chart below.

This is a negative indicator for most banks involved in the actual business of banking, even as the spreads between Fed money and money on loan widen.

Advantage goes to those banks who are gaming the markets, also known as trading profits, which is probably the opposite outcome which Tim and Ben would desire, if they were thinking about it.

Should banks be trading in the markets at all for their own accounts? We think not.

Glass-Steagall should be reintroduced as quickly as possible to get the banks back in the business of banking."

America is Being Looted - Apr. 14, 2009 | Blogs at Chris Martenson - Chris Martenson's Blog, geithner, Goldman Sachs, TARP

Chris Martenson's Blog - America is Being Looted - Apr. 14, 2009 | Blogs at Chris Martenson - Chris Martenson's Blog, geithner, Goldman Sachs, TARP: "America is Being LootedTuesday, April 14, 2009, 9:20 am, by cmartenson

As cynical as I am, I just can’t keep up.

That sentence is a paraphrase of a quote by Lily Tomlin that reads, “No matter how cynical you become, it's never enough to keep up.”

I have long been a cynic of the bailouts, and, unfortunately, I cannot detect even the slightest sliver of daylight between the prior and current administrations. The reason, I fear, is captured by this quote from Simon Johnson, the former Chief Economist at the IMF and current professor at MIT’s Sloan School of Management:

The crash has laid bare many unpleasant truths about the United States. One of the most alarming, says a former chief economist of the International Monetary Fund, is that the finance industry has effectively captured our government—a state of affairs that more typically describes emerging markets, and is at the center of many emerging-market crises. If the IMF’s staff could speak freely about the U.S., it would tell us what it tells all countries in this situation: recovery will fail unless we break the financial oligarchy that is blocking essential reform. And if we are to prevent a true depression, we’re running out of time."

As cynical as I am, I just can’t keep up.

That sentence is a paraphrase of a quote by Lily Tomlin that reads, “No matter how cynical you become, it's never enough to keep up.”

I have long been a cynic of the bailouts, and, unfortunately, I cannot detect even the slightest sliver of daylight between the prior and current administrations. The reason, I fear, is captured by this quote from Simon Johnson, the former Chief Economist at the IMF and current professor at MIT’s Sloan School of Management:

The crash has laid bare many unpleasant truths about the United States. One of the most alarming, says a former chief economist of the International Monetary Fund, is that the finance industry has effectively captured our government—a state of affairs that more typically describes emerging markets, and is at the center of many emerging-market crises. If the IMF’s staff could speak freely about the U.S., it would tell us what it tells all countries in this situation: recovery will fail unless we break the financial oligarchy that is blocking essential reform. And if we are to prevent a true depression, we’re running out of time."

The Credit Bubble Was a Ponzi Scheme Enabled by the US Dollar

Jesse's Café Américain: The Credit Bubble Was a Ponzi Scheme Enabled by the US Dollar: "They say a picture is worth a thousand words.

Here is a picture of the US credit bubble, with the deleveraging which has just begun.

It is/was a Ponzi scheme, enabled by the advantages of controlling the reserve currency of the world, pure and simple.

It was the US dollar that was monetized, or more specifically US debt obligations, which are now substantially worthless and will have to take a significant haircut in real terms. This is similar to the Japanese experience in which they monetized their real estate."

Here is a picture of the US credit bubble, with the deleveraging which has just begun.

It is/was a Ponzi scheme, enabled by the advantages of controlling the reserve currency of the world, pure and simple.

It was the US dollar that was monetized, or more specifically US debt obligations, which are now substantially worthless and will have to take a significant haircut in real terms. This is similar to the Japanese experience in which they monetized their real estate."

Friday, April 17, 2009

China Financial Markets

China Financial Markets: "New trade and reserve numbers from China

April 13th, 2009 by Michael Pettis Filed in Balance of payments, Consumption and production, Exports and imports, Hot money, Reserves

Exports in March dropped a less-than-expected 17.1% from the same time last year – below expectations of 20% and the 21.1% drop for the first two months of 2009. Most of the articles I read in the Chinese and foreign press including, not surprisingly, comments from the customs bureau, hailed this as a sign that the export slump is bottoming out. According to an article in Saturday’s South China Morning Post, for example"

April 13th, 2009 by Michael Pettis Filed in Balance of payments, Consumption and production, Exports and imports, Hot money, Reserves

Exports in March dropped a less-than-expected 17.1% from the same time last year – below expectations of 20% and the 21.1% drop for the first two months of 2009. Most of the articles I read in the Chinese and foreign press including, not surprisingly, comments from the customs bureau, hailed this as a sign that the export slump is bottoming out. According to an article in Saturday’s South China Morning Post, for example"

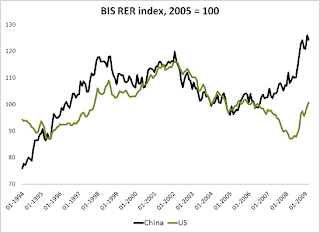

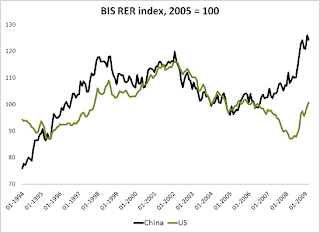

The US doesn’t name China a currency manipulator

The US doesn’t name China a currency manipulator

Posted on Wednesday, April 15th, 2009

By bsetser

Posted on Wednesday, April 15th, 2009

By bsetser

Make no mistake, China’s currency still looks undervalued. It is only a bit higher — according to the BIS index– than it was in 2001 or 2002, back when China was exporting a fraction of what it does now. In other words, the rise in the productivity of China’s economy hasn’t been mirrored by a rise in the external purchasing power of its currency. That is a big reason why China’s current account surplus remains large.

And the underlying issue remains: the biggest driver of moves in China’s real exchange rate remains moves in the dollar. History suggests that China cannot count on dollar appreciation to bring about the real appreciation it and the global economy need if China’s surplus — and thus China’s accumulation of money-losing foreign assets — is going to come down. It will be hard — in my view — to have a stable international monetary system if the currencies of all the major economies but one float against each other. And China is now a major economy by any measure.

And the underlying issue remains: the biggest driver of moves in China’s real exchange rate remains moves in the dollar. History suggests that China cannot count on dollar appreciation to bring about the real appreciation it and the global economy need if China’s surplus — and thus China’s accumulation of money-losing foreign assets — is going to come down. It will be hard — in my view — to have a stable international monetary system if the currencies of all the major economies but one float against each other. And China is now a major economy by any measure.

Thursday, April 16, 2009

Rouse default swaps worth 29.25 percent in auction

NEW YORK, April 15 (Reuters) - Credit default swaps insuring the debt of The Rouse Company, a unit of General Growth Properties Inc GGP.N, were found to be worth 29.25 percent of the debt they insure in an auction on Wednesday to determine the contracts' value, auction administrators said.

That means that sellers of protection will need to pay out 70.75 percent of the value of the bonds they insured, or $7.07 million per $10 million of insurance sold. Credit default swaps are used to insure against a borrower defaulting.

Payments on the contracts were triggered after the company failed to pay more than $2 billion in debt due on March 16.

A group of General Growth's bondholders have asked their trustee to sue the mall owner for payment on their past-due bonds, The Wall Street Journal reported on Monday. For details, see [ID:nN13392097..

Norton's note: GGP.N who owns the Maine Mall has filed ch 11 bankrupcy April 16, 2009. Ouch!

That means that sellers of protection will need to pay out 70.75 percent of the value of the bonds they insured, or $7.07 million per $10 million of insurance sold. Credit default swaps are used to insure against a borrower defaulting.

Payments on the contracts were triggered after the company failed to pay more than $2 billion in debt due on March 16.

A group of General Growth's bondholders have asked their trustee to sue the mall owner for payment on their past-due bonds, The Wall Street Journal reported on Monday. For details, see [ID:nN13392097..

Norton's note: GGP.N who owns the Maine Mall has filed ch 11 bankrupcy April 16, 2009. Ouch!

Monday, April 13, 2009

Changing the Rules of the Blame Game

A cartoon in the Sunday comics shows that mustachioed fellow with monocle and top hat from the Monopoly game--"Rich Uncle Pennybags," he used to be called--standing along the roadside, destitute, holding a sign: "Will blame poor people for food." ..

A cartoon in the Sunday comics shows that mustachioed fellow with monocle and top hat from the Monopoly game--"Rich Uncle Pennybags," he used to be called--standing along the roadside, destitute, holding a sign: "Will blame poor people for food." ..Bill Black wrote a book about his experiences with a title that fits today as well as it did when he published it four years ago--The Best Way to Rob a Bank Is to Own One. On last Friday night's edition of Bill Moyers Journal, he said the current economic and financial meltdown is driven by fraud and banks that got away with it, in part, because of government deregulation under prior Republican and Democratic administrations. [Watch it here.www.pbs.org/moyers/journal/04032009/profile.html#savingsandloan] "Now we know what happens when you destroy regulation," Black said. "You get the biggest financial calamity for anybody under the age of 80."...

Black asked, "Why would we keep CEO's and CFO's and other senior officers that caused the problems? That's nuts... We're hiding the losses instead of trying to find out the real losses? Stop that... Because you need good information to make good decisions... Follow what works instead of what's failed. Start appointing people who have records of success instead of records of failure... There are lots of things we can do. Even today, as late as it is. Even though we've had a terrible start to the [Obama] administration. They could change, and they could change within weeks."

He called for a 21st century version of the Pecora Commission, referring to hearings that sought the causes of the Great Depression, held during the 1930's by the US Senate Committee on Banking and Currency.

Ferdinand Pecora was the committee's chief counsel and interrogator, a Sicilian émigré who was a progressive devotee of trust busting Teddy Roosevelt and a former Manhattan assistant district attorney who successfully helped shut down more than a hundred Wall Street "bucket shops" selling bogus securities and commodity futures. He was relentless in his cross-examination of financial executives, including J.P. Morgan himself.

Pecora's investigation uncovered a variety of Wall Street calumnies - among them Morgan's "preferred list" of government and political insiders, including former President Coolidge and a Supreme Court justice, who were offered big discounts on stock deals. The hearings led to passage of the Securities Act of 1933 and the Securities Exchange Act of 1934.

In the preface to his 1939 memoir, Wall Street under Oath, Ferdinand Pecora told the story of his investigation and described an attitude amongst the Rich Uncle Pennybags of the financial world that will sound familiar to Bill Black and those who seek out the guilty today.

"That its leaders are eminently fitted to guide our nation, and that they would make a much better job of it than any other body of men, Wall Street does not for a moment doubt," Pecora wrote. "Indeed, if you now hearken to the Oracles of The Street, you will hear now and then that the money-changers have been much maligned. You will be told that a whole group of high-minded men, innocent of social or economic wrongdoing, were expelled from the temple because of the excesses of a few. You will be assured that they had nothing to do with the misfortunes that overtook the country in 1929-1933; that they were simply scapegoats, sacrificed on the altar of unreasoning public opinion to satisfy the wrath of a howling mob...."

According to Politico.com, at his March 27 White House meeting with the nation's top bankers, President Obama heard similar arguments and interrupted, saying, "Be careful how you make those statements, gentlemen. The public isn't buying that.... My administration is the only thing between you and the pitchforks."

Stand aside, Mr. President, and let us prod with our pitchforks to get at the facts."

He called for a 21st century version of the Pecora Commission, referring to hearings that sought the causes of the Great Depression, held during the 1930's by the US Senate Committee on Banking and Currency.

Ferdinand Pecora was the committee's chief counsel and interrogator, a Sicilian émigré who was a progressive devotee of trust busting Teddy Roosevelt and a former Manhattan assistant district attorney who successfully helped shut down more than a hundred Wall Street "bucket shops" selling bogus securities and commodity futures. He was relentless in his cross-examination of financial executives, including J.P. Morgan himself.

Pecora's investigation uncovered a variety of Wall Street calumnies - among them Morgan's "preferred list" of government and political insiders, including former President Coolidge and a Supreme Court justice, who were offered big discounts on stock deals. The hearings led to passage of the Securities Act of 1933 and the Securities Exchange Act of 1934.

In the preface to his 1939 memoir, Wall Street under Oath, Ferdinand Pecora told the story of his investigation and described an attitude amongst the Rich Uncle Pennybags of the financial world that will sound familiar to Bill Black and those who seek out the guilty today.

"That its leaders are eminently fitted to guide our nation, and that they would make a much better job of it than any other body of men, Wall Street does not for a moment doubt," Pecora wrote. "Indeed, if you now hearken to the Oracles of The Street, you will hear now and then that the money-changers have been much maligned. You will be told that a whole group of high-minded men, innocent of social or economic wrongdoing, were expelled from the temple because of the excesses of a few. You will be assured that they had nothing to do with the misfortunes that overtook the country in 1929-1933; that they were simply scapegoats, sacrificed on the altar of unreasoning public opinion to satisfy the wrath of a howling mob...."

According to Politico.com, at his March 27 White House meeting with the nation's top bankers, President Obama heard similar arguments and interrupted, saying, "Be careful how you make those statements, gentlemen. The public isn't buying that.... My administration is the only thing between you and the pitchforks."

Stand aside, Mr. President, and let us prod with our pitchforks to get at the facts."

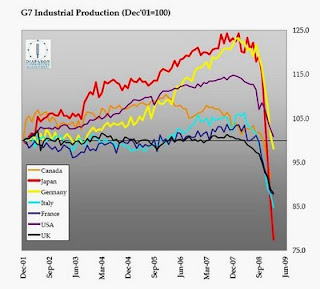

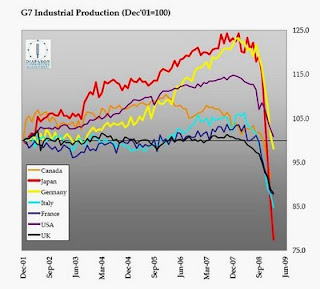

G7 Industrial Production Crashing

Jesse's Café Américain: "11 April 2009

G7 Industrial Production Crashing

The production of real goods in the developed nations is plummeting. Even the mighty export driven economy of Japan appears to be heading lower as though it had fallen off a cliff.

Countries must begin to encourage consumption in their own economies. To do this, they ought not to be stimulating the old credit/speculation machine called the neo-liberal financial system"

G7 INDUSTIRAL PRODUCTION

G7 Industrial Production Crashing

The production of real goods in the developed nations is plummeting. Even the mighty export driven economy of Japan appears to be heading lower as though it had fallen off a cliff.

Countries must begin to encourage consumption in their own economies. To do this, they ought not to be stimulating the old credit/speculation machine called the neo-liberal financial system"

And the Baltic shipping index has returned to a down trend. Record number of cargo ships are in dry dock. BALTIC DRY INDEX (ABOVE)

BALTIC DRY INDEX (ABOVE)

G7 INDUSTIRAL PRODUCTION

Subscribe to:

Posts (Atom)